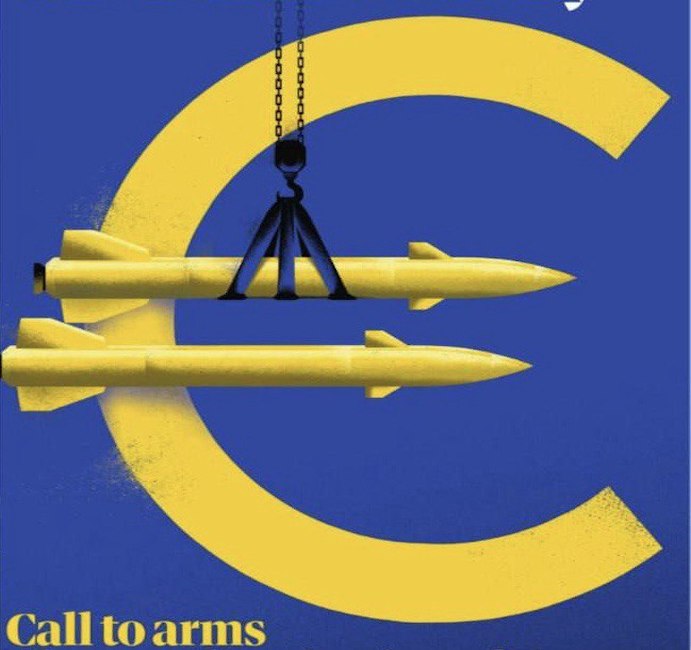

EU's ReArm Europe Strategy: A Shift Towards Military Spending Amid Economic Challenges

Armarsi a debito. La Finanza armata dell’Unione 🔗

The text discusses the European Union's military financing strategy, specifically through the resolution 0146/2025, which aims to enhance military capabilities amid economic turmoil. This plan, known as ReArm Europe, involves a significant budget of 800 billion euros for defense, largely funded through debt, which may lead to adverse economic impacts such as increased public debt and reduced public welfare. The resolution encourages member states to prepare for extreme military scenarios and relaxes existing regulations on arms exports, raising concerns about the potential for a militarized Europe. It highlights the shift from social welfare to military spending, arguing that investments in defense could detract from essential public services. The text emphasizes that Italy may face challenges in financing its debt amid competition from other European nations and the involvement of major investment funds like Blackrock.

- The EU's resolution 0146/2025 aims to prepare for military engagement with Russia by increasing arms supplies.

- ReArm Europe proposes a budget of 800 billion euros for defense, funded largely through debt, risking economic stability.

- Public welfare spending may decrease as military expenditures rise, potentially leading to cuts in social services.

- Italy faces competition in debt financing, which could increase its public debt burden and interest payments.

- Major investment firms may play a significant role in financing military initiatives, raising concerns about the prioritization of military over social needs.

What is the purpose of the EU's resolution 0146/2025?

The resolution aims to enhance European military capabilities in response to tensions with Russia, committing to increased arms supplies and military readiness.

How will ReArm Europe affect Italy's economy?

ReArm Europe may lead to increased public debt and higher interest payments, as Italy competes with other EU countries for financing, potentially resulting in cuts to public welfare services.

What role do investment firms like Blackrock play in this context?

Investment firms may be approached to absorb Italian debt, implying a reliance on private capital to finance military spending, which could detract from essential public services.